Many communities are looking for ways to track all their finances in one place. We work with several communities that approach the issue of members’ deaths differently. Some prefer to contribute when such an event occurs and have policies around how much each member needs to contribute. In contrast, others take a more proactive approach by either registering members to a Last Expense Insurance Policy or saving the funds in a Money Market Fund (MMF) account to grow the base of the savings to support such events.

But which is the most effective strategy?

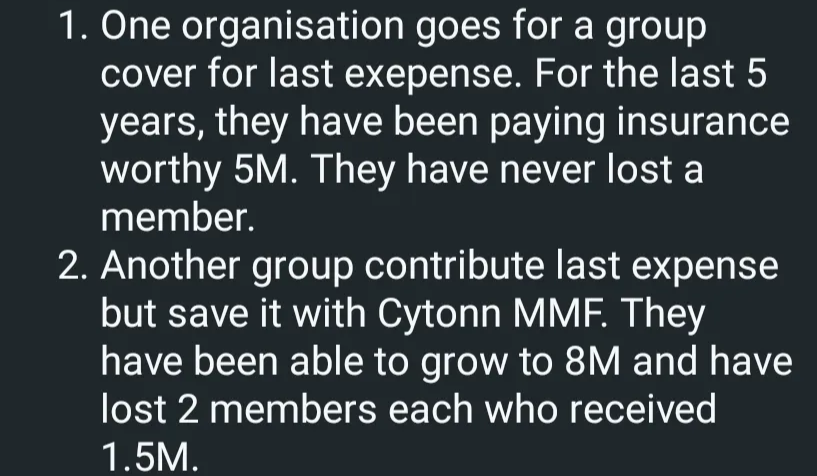

This conversation was sparked by a post by a member of one of the communities.

Each of these strategies works for the communities that use them; however, each has its own advantages and drawbacks. Let’s look at each one by one and the instances where they would be effective.

- Fundraisers

Fundraising is usually the default option for most communities because of the ease of getting one started and the general familiarity with this model, which has decades of cultural heritage. However, it does present several weaknesses in implementation within structured groups. First, it is unpredictable – there is no guarantee that certain targets will be met. Additionally, when funerals coincide with periods of recession or low finances, raising funds can be challenging. Most groups who have done fundraisers in the middle of January will attest to how difficult it can be. Secondly, this model is also susceptible to influencer or popularity effects, where some members may receive disproportionately larger contributions compared to others based on their influence in the community/group. This can often cause tension within the community.

Despite these weaknesses, fundraising does offer a quick way to get funds, especially from ad-hoc communities or where structures are not well-formed or don’t exist. For larger groups, this might be a better option as it ensures broader participation.

Majority of fundraisers in community groups tend to get participation from between 15-20% of group members. With mobilization and gamification, this could go up to about 60%. On average, funeral fundraisers get about 25% participation. This is advantageous for larger groups.

- Money Market Funds (MMFs)

Communities preferring MMFs for bereavement support tend to be tighter groups/communities with some governance structures and a longer-term outlook. One of the upsides of MMFs is that they are liquid and can be available at a moment’s notice in case of a bereavement. This is also its weakness, as the funds can also be liquidated instantly, defeating the objectives for which they were set up. Despite this, it offers the additional advantage that the funds grow over time.

For communities, the MMF approach allows them to get 100% participation from members anytime there is a bereavement support; however, they also need to have policies around how much support is offered in case of a bereavement and the frequency of savings to help grow this.

The greatest advantage of this option is that as the fund grows, the community can reduce its dependence on member contributions to sustain this or at least reduce the frequency without affecting the effectiveness of the support or reducing the support level.

There are several money market fund managers that can provide this to groups and individuals.

- Last Expense Insurance

This is another option for organized communities. A lot of communities going for this option often come from contribution/fundraiser fatigue and are looking for an option to still support or assist members during bereavement without fully depending on contributions. The one major limitation of this option is that the payout is predefined and fixed for the duration of the policy. This may limit its adoption as different community members tend to have differing payout preferences.

An often overlooked advantage of this option is that it’s a passive risk management approach and does not require the group members to engage after the policy is activated. For busy, informally structured communities, this could be a great advantage.

Nobuk Collect enables any community looking to use any of these options (or even all of these options) to integrate these into their one link. Communities can collect these funds together with all the other payments they make as a community. For instance, if they are paying for savings to a bank account, and also have some active funds in an MMF, they can add these accounts directly to their link and enable members to pay directly to these accounts from one payment link.

If you’re looking to find out how Nobuk can assist, please reach out.

Leave a Reply